Report: Despite Price Volatility Blockchain and Crypto Jobs Are In Demand

Glassdoor Economic Research is delivering much needed good news to the crypto community saying that despite extreme price volatility and regulatory uncertainty, the number of crypto jobs in the blockchain and cryptocurrency sector has risen by 300 percent since the same time last year.

Saying that “the professionalism of the space has accelerated,” the report notes that “continued growth in job openings suggests that blockchain employers remain confident in the market opportunity and continue to make long-term investments in their teams.”

Using their substantial job search site to search out blockchain and cryptocurrencies jobs, Glassdoor Research learned that, in August 2018, there were 1,775 unique blockchain-related job openings in the U.S. By comparison, in August last year, there were only 446 similar job listings, representing a 300 percent year-over-year increase.

“Hiring and jobs is a much more stable metric to observe when looking at the health of an industry, compared to the stock market or currency values that can, and do, fluctuate daily,” Glassdoor economist Daniel Zhao, who worked on the study, told Bitcoin Magazine:

“What the strong surge in job growth that we see on Glassdoor shows is that there is a clear interest in investing in workers with skills related to Bitcoin and other digital currencies.”

"Bitcoin-Related" Skills Are in DemandOne of the report’s surprises is that more cryptocurrency jobs were created than blockchain jobs, as what Zhao referred to as "Bitcoin-related" skills were the most in demand, despite recent price volatility.

“There’s been a lot of Bitcoin buzz among financial investors as well as the general public that’s grown quickly over the last few years. What our research found was a 300 percent growth in online job postings for Bitcoin-related jobs compared to the previous year, which is a significant surge.

“Although we’ll continue to watch and see where Bitcoin is headed, for employers to make these investments is a sign that they see it as a growing industry,” he stated.

Who's Looking and What ForAs far as job occupations listed, engineering, technology and science jobs made up 55 percent of the jobs posted.

Software engineers were most in demand, accounting for almost 20 percent of the technical job listings.

Others on the list included analyst relations manager, product manager, risk analyst and marketing manager.

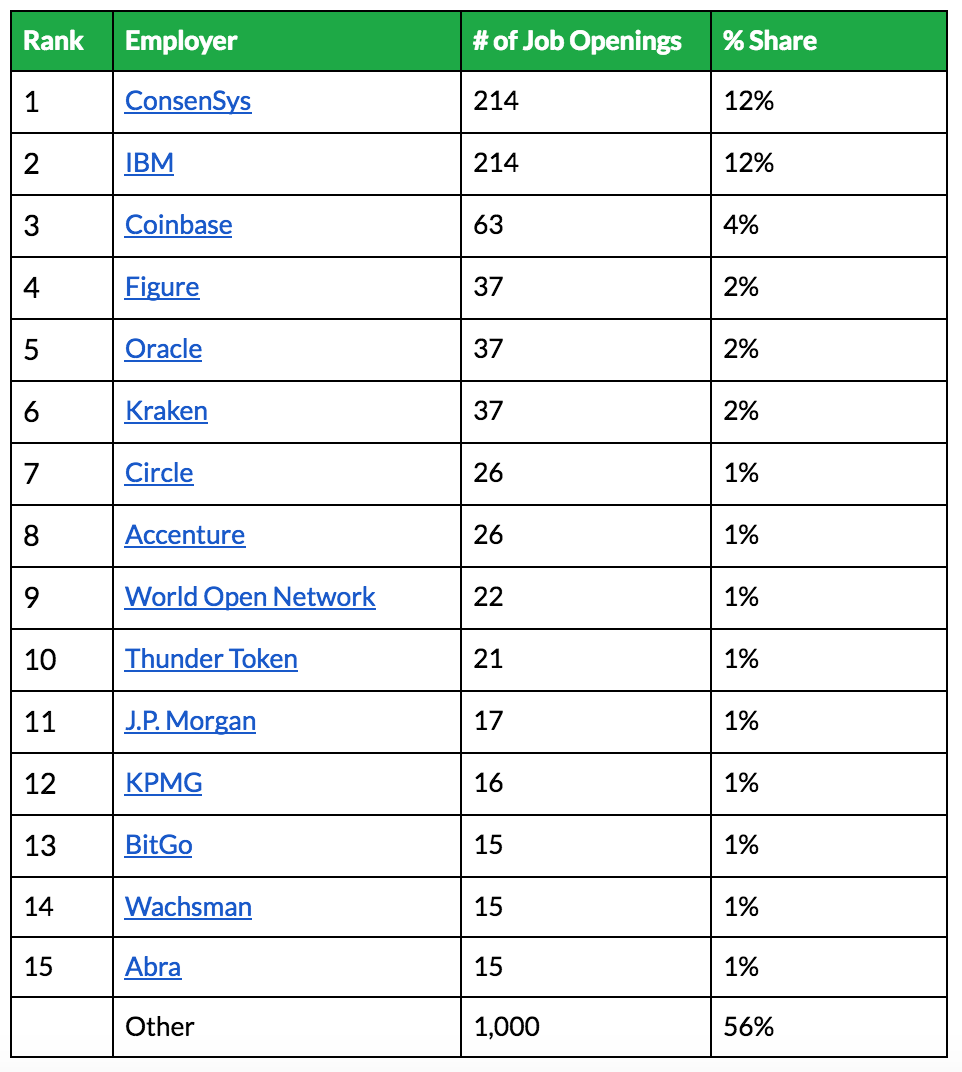

As can be seen in the following chart from the report, IBM and ConsenSys had the most blockchain- and cryptocurrency-related job listings, while other companies like Coinbase and Kraken were also hiring.

Top 15 Employers Hiring for Blockchain-Related Jobs

The report notes that some consulting or professional services firms like Accenture and KPMG are hiring people specifically to advise their clients on how to apply new blockchain technologies.

Better Pay for Blockchain JobsLikely due in part to a competitive market where growing demand is outstrippng the supply of trained workers, companies hiring are offering higher than average compensation. The median salary for crypto jobs is $84,884, well above the median salary for all U.S. jobs.

Zhao added: “Our data found that not only is there a growing interest for Bitcoin-related talent among companies both large and small and at companies across the country, but these roles often pay more than the U.S. median salaries. We found Bitcoin roles pay $84,884 per year, which is about 62 percent more than the U.S. median salary.”

Cities With the Greatest DemandNew York City and San Francisco represent a disproportionate share of blockchain-related jobs at 24 percent and 21 percent of total job openings. San Jose (6 percent), Chicago (4 percent) and Seattle (4 percent) round out the top five cities for blockchain job openings.

“I also found it interesting to see the spread of Bitcoin-related opportunities across the United States. Although it’s no surprise to see that most job opportunities reside in the financial hub of New York, our data shows that companies across the U.S. and even several mid-sized cities are looking for this type of talent. What we’ve seen is that in some of these mid-sized cities, local organizations have established initiatives to help put them on the map for Bitcoin and cryptocurrency talent,” said Zhao.

Internationally, London topped the list with 189 blockchain-related job openings, followed by Singapore, Toronto and Hong Kong.

Is Bitcoin Here to Stay?Asked if he thinks this growth in jobs is unusual compared to other sectors, Zhao said:

“The growth in the blockchain industry has looked like the broader tech boom. Similar to the technology industry, Bitcoin-related jobs are concentrated in certain talent hubs, with higher than average salaries for workers as investment pours in. Plus, both startups and larger companies alike are investing in this sector — all things we’ve seen shape the tech job market.”

With continuing market volatility and uncertainty around what regulators plan to do, it’s a legitimate question to ask if the cryptocurrency industry is here to stay for the long haul.

Zhao is confident that it is, conveying that investing in jobs is an excellent indicator:

“Although there’s often news about the fluctuating prices of digital currencies, hiring is a long-term decision that an organization sees a true business value in hiring people with specific skill sets that can contribute to the business. It’s a decision not made on a whim.”

This article originally appeared on Bitcoin Magazine.

https://www.coindebate.com/2018/10/report-despite-price-volatility.html

Fidelity Is Launching a Crypto Trading Platform

https://www.coindebate.com/2018/10/fidelity-is-launching-crypto-trading.html

As Tetherҳ Peg Slips, Bitcoin Price Is Distorted Across Market

Tether’s peg is slipping, and an exchange-wide firesale has led to major price discrepancies between bitcoin’s BTC/USDT and BTC/USD trading pairs across the market.

In the early hours of October 15, 2018, Tether’s USDT was trading at $0.92, the lowest asking price the coin has seen in 18 months. At the time of writing, the stablecoin still hasn’t made up enough ground to retain its $1 peg. On most markets, it’s currently trading around $0.96, though this figure is tied to bitcoin trading pairs. Against the USD on Kraken and Bittrex, it is trading at $0.92 and $0.90, respectively.

A combination of exchange activity, related FUD and scuttlebutt could be the catalysts behind the sell-off. Bitfinex suspended fiat deposits on October 15, 2018, “for certain customer accounts in the face of processing complications,” a blog post reveals. In addition, Binance temporarily suspended USDT withdrawals for “wallet maintenance” due to “network congestion,” a measure taken after the exchange extinguished rumors that said it would soon delist tether.

The discount has bitcoin trading at something of a premium against tether on exchanges with USDT/BTC trading pairs. On Binance, Huobi and Bittrex, for example, 1 BTC is trading for nearly 6,700 USDT.

Contrast this with bitcoin’s price in USD/BTC markets and it becomes clear that tether’s sell-off is distorting prices across exchanges. On Coinbase Pro, Kraken and Gemini, bitcoin is trading at roughly $6,400 against USD pairs, an indication that bitcoin’s proper asking price is much lower than its oft-cited USDT pair would advertise. This has led to an inflated price averaged on CoinMarketCap of $6,650.

It’s important to note that the “premium” bitcoin is going for on tether-listed exchanges is less of a premium and more of a price distortion, given that tether is trading below its peg. The price of bitcoin for these pairs has spiked as a result of the sell-off, but if you sold USDT for BTC and then attempted to resell this BTC for USD, the arbitrage opportunity would be nullified by the price differential between BTC/USDT and BTC/USD pairs.

Notably, Bitfinex’s USD/BTC pair is out of line with other exchanges that offer fiat pairs for bitcoin. On Bitfinex, 1 BTC is trading at $6,900, a figure the even superseded its price against USDT on other popular exchanges. An inauspicious discrepancy in its own right, Bitfinex’s data may rouse additional skepticism when we take a look at its USDT/USD pair. At the time of writing, 1 USDT is trading at exactly $1.00 against its pegged asset in actual U.S. dollars, while, as we noted earlier, the same trading pair on Kraken and Bittrex is going for $0.92 and $0.90, respectively. Seeing as Tether and Bitfinex are under like management, the stark departure in price for USDT/USD markets between Bitfinex and other top exchanges could be cause for further concern.

This jumble of numbers and price differentials leaves more questions asked than answers, aggravating the uncertainty that likely led to the sell-off in the first. The price gap between bitcoin’s USD and USDT pairs puts tether’s risk premium at just under $500 (7.62 percent), according to Untether.space.

As the discrepancy in prices across exchanges illustrates, this risk premium denotes the difference between how much bitcoin is trading for in BTC/USDT versus BTC/USD pairs. Ultimately, the figure could indicate that market confidence in Tether is waning, as looming uncertainty over whether Tether has enough funds in the bank, amidst other banking troubles, has shaken investor trust in the market’s number one stablecoin, which accounts for 98 percent of all stablecoin trading volume.

Tether’s troubles comes after a slew of new stablecoins have proliferated in the market. Its two largest competitors, MakerDAO’s DAI and TrustToken’s TUSD, launched earlier this year, while regulation grade coins like Gemini’s GUSD, Paxos’ PAX and Circle’s USDC launched last month as well. In addition to these, the industry’s first algorithmic stablecoin, Kowala’s kUSD, is now in its mainnet’s alpha version, though the coin has yet to begin trading on the open market.

This article originally appeared on Bitcoin Magazine.

https://www.coindebate.com/2018/10/as-tethers-peg-slips-bitcoin-price-is.html